Gold rebounds from biggest weekly drop this year as funds expand

- by Minnie Bishop

- in Research

- — Oct 11, 2016

It has since recovered as traders weigh up the timing of an United States interest rate hike this year after payrolls data on Friday came in softer than expected, bolstering expectations that hikes would only be gradual.

The gold price continued to rise on Monday, October 10 in morning trading, finding support from Chinese buying and disappointing U.S. data.

Spot gold was recently quoted at $1,263/1,263.40 per oz, up $5.50 on Friday's close - it had fallen to a four-month low last week of $1,240.

On Monday gold staged a bit of a comeback with December futures trading on the Comex market in NY exchanging hands at $1,265.20 an ounce in European trade, up more than $13 from Friday's close.

Gold is highly sensitive to rising US interest rates, as these increase the opportunity cost of holding non-yielding bullion, while boosting the dollar, in which it is priced.

Hedge funds and money managers reduced their net long positions in COMEX gold contracts to four-month lows in the week to October 4, as prices tumbled, US government data showed. Total holdings in physically backed gold exchange-traded funds stood at 2,335.6 tonnes, a 38.1-tonne month-on-month increase.

"The market was crucially lacking that element of physical support (last week) that we would normally expect to at least keep a floor under prices", Mitsubishi analyst Jonathan Butler said.

Hurts, Alabama defense, lead way to 49-30 win over Arkansas

That will not be easy to do with the Tide going to a spread offense with freshman quarterback Jalen Hurts running the show. Turner had 75 of his 113 yards rushing against Texas A&M on one play last week. "Obviously we like to run the football".

The safe haven asset was fairly subdued in its reaction to the second US presidential debate between Democrat Hillary Clinton and Republican Donald Trump, analysts said.

"When you see prices get that low you're going to have people come in and start buying gold ETFs and physical gold", Phil Streible, a senior market strategist at RJO Futures in Chicago, said in a telephone interview.

Financial markets saw less chance of a victory by Trump in his USA presidential bid amid a scandal over vulgar comments he made about women.

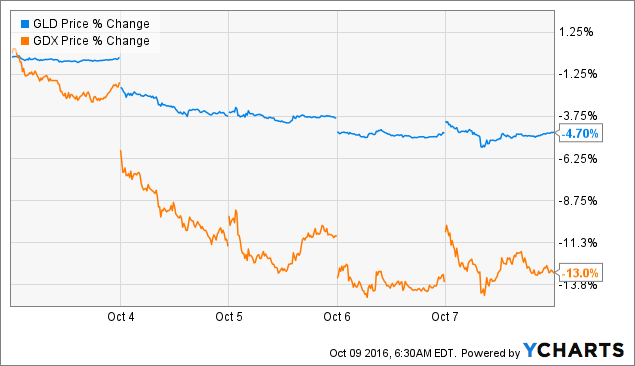

Goldman Sachs Group Inc. has said that a drop in gold prices significantly below $1,250 an ounce would present investors with a strategic buying opportunity, with the metal offering protection against risks to global growth and limits to central banks' effectiveness. Spot gold ended about 4.5 percent lower last week, its biggest weekly decline since November 2015.

"We expect gold to remain buoyant, looking for support around $1,250 following Friday's encouraging move back above the level on the less than impressive United States jobs data", MKS PAMP Group trader Sam Laughlin said in a note.

Palladium snapped a five-session fall, and was 0.3 per cent higher at $US666.90.